Changes in the maximum contribution basis for Social Security

Art. 122. One of Law 31/2022, of December 23, on General State Budgets by 2023

As every year, the maximum contribution base is updated with corresponding CPI.

Amount. This year, the increase has been 8% becoming € 4,139.70 to € 4,595.50.

Application. All those salaries exceeding € 49,676.40 will have been affected with effects of 01/01/2023, with a higher cost in social security contributions, both by the employee and by the company.

MEI application (intergenerational equity mechanism)

D.F. 4th of Law 21/2021, of December 28

Contribution mechanism. The intergenerational equity mechanism (MEI) is a new type of contribution that has begun to be applied from 1-1-2023 and that affects both foreign workers and companies and autonomous professionals. This mechanism is intended to prevent the younger generations from assuming all the weight of retirement, distributing quotes in a balanced way and strengthening the long -term pension system.

Item. This new price will be 0.6% based on common contingency contingency. The worker will assume 0.1% of the total and the company must assume the remaining 0.5% (the self -employed will assume the totality of 0.6%). This is about 12 euros per month for a 2,000 euros regulatory base (in this case, 10 euros would correspond to the company and 2 euros to the worker).

Temporary. This measure is temporary. The State intends to raise around 40,000 million euros for the Social Security Reserve Fund and, when this figure is reached, the mechanism will be reviewed.

New IRPF 2023 quotas

Law 31/2022, of December 23, of General State Budgets by 2023

The most outstanding measures are the following:

- Fiscal reduction for income less than € 21,000.

- Increase in the annual gross salary from which it is mandatory to make the income statement for those single people who do not have children (from € 14,000 to 15,000).

- Increase in the annual gross salary from which it is mandatory to make the income statement for those salaried people who have two children (from € 18,000 to 19,000).

- Income exceeding € 200,000 and less than € 300,000 suffer a 1% rise (from 26% to 27%)

- Income greater than € 300,000 will pay 28%.

This implies a modification in the retentions on account that companies must apply from February 2023 in the payment of payrolls to their employees.

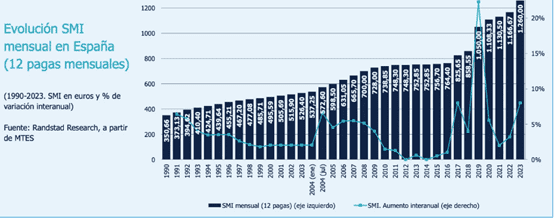

New minimum salary (SMI) 2023

By RD 99/2023, the amount of the SMI in force from 1-1-2023 is set, being established at 36 euros per day or 1,080 euros per month, 15.120€ per year.

These amounts are an 8% increase with respect to those set until December 2022.

Upcoming normative changes

On April 1, 2023, the Royal Decree 1060/2022 will enter into force, which regulates certain aspects of the management and control of the processes for temporary disability in the first 365 days of its duration.

One of the novelties of this RD is that the doctor of the public health service will only deliver a copy of the low, confirmation and high part to the working person, eliminating the second copy and avoiding, thus, that she is the one who has to Deliver the part to the company.

All notifications will be via telematics and the form that companies will have to know the data related to the medical parts of low, confirmation and high will be through the file files:

FI: (files files): It is a communication channel created by the National Social Security Institute (INSS) in December 2019, through which companies can receive a daily file in which the modifications that have been Produced in the databases of the INSS benefits, identifying the affected worker, the contribution account code to which it is linked and the nature of the variation that has occurred. It is, in short, a tool that helps companies in the management of their staff and their social security contributions. The information contained in the INSS Companies file is sent to the users of the Network System through the programs of the General Social Security Treasury: Siltra/Winsuite32 or Editran.

Companies must send economic data (contribution bases, CCC, etc.) to INS company via Fie/Fier. Therefore, the obligation of companies to transmit telematic data in confirmation and high parts is suppressed. As a novelty, among these economic data, which will be specified in Annex III of the Order developed by RD 1060/2022, two new fields have been introduced, one related to the job and another related to the description of functions of the working person, which involves the development of a new version of the FDI/FRI protocol that will soon be published for their knowledge and technical adaptation.

The information that these two new fields will contain is very relevant for medical control that regarding the temporary disability processes of the workers has to carry out both the INSS and the public health services and the mutual collaborators with the Social Security, since it will allow adjusting These processes and their duration based on the tasks effectively carried out by the worker, both in the face of his recovery and his reinstatement to the company. In the next few days, more detailed information will be provided about the new version of the FDI/FRI protocol for technical knowledge and adaptation.